Union Budget 2025: Key Highlights and Impacts

The Union Budget 2025 offers a deep dive into India's fiscal plans, aiming to boost economic growth and improve social welfare. This year's budget introduces major reforms and allocations, showing a dedication to sustainable development and job creation post-pandemic. It's vital for stakeholders and the public to grasp the Union Budget 2025's key points. This understanding helps in evaluating the expected economic effects across various sectors.

Key Takeaways

Union Budget 2025 prioritizes infrastructure investments to boost economic growth.

New fiscal policies aim to enhance social welfare and actively support recovery post-pandemic.

Significant allocations are made to healthcare and education sectors.

Strategic measures for SMEs and startups are included to drive innovation and entrepreneurship.

The budget sets a positive tone for GDP growth with anticipated sectoral growth projections.

Public response indicates varying expectations among different stakeholder groups.

Introduction to Union Budget 2025

The Union Budget 2025 introduction highlights a strategic focus on boosting the country's fiscal health and economic strategy. It emphasizes infrastructure development and social commitments, aiming to balance fiscal challenges. This budget offers potential solutions to fight inflation and adapt to global economic shifts.

Experts and policymakers are keenly watching how the Union Budget 2025 will tackle these challenges while maintaining growth. It will underscore key government priorities, offering a detailed response to the nation's socioeconomic issues.

Union Budget 2025 introduction

The budget promises sustained investment in vital sectors, marking a cornerstone of its economic strategy. The proposed actions aim to boost economic activities and create a favorable environment for sustainable growth.

Focus Area Description Infrastructure Investments to improve Development transport, energy, and urban facilities. Social Programs to enhance welfare Initiatives healthcare, and education standards. Fiscal Health Strategies to manage public debt and control inflation. Global Responsive measures to Economic varying international trade Adjustments conditions.

Key Highlights of Union Budget 2025

The Union Budget 2025 outlines the government's plan to boost economic stability and growth. It focuses on fiscal measures and policies to support various sectors and ensure the wellbeing of the population. This budget sets a solid foundation for future growth across the nation.

Fiscal Measures and Policies

The budget's fiscal measures aim to optimize tax structures and increase revenue. Key strategies include:

Streamlining tax compliance to enhance transparency.

Implementing new revenue policies aimed at reducing deficits.

Adjustments in excise duties to stimulate market growth.

These economic policies aim to bolster financial stability and promote sustainable economic development.

Infrastructure Development Plans

Investments in infrastructure are a top priority in the Union Budget. Significant allocations will focus on:

- Expanding transportation networks, including roads and railways.

- Upgrading urban development projects to improve city environments.

- Enhancing digital infrastructure to support innovation.

The emphasis on infrastructure development aims to enhance connectivity and drive productivity across industries.

Social Welfare Initiatives

Commitment to social welfare is evident through various initiatives aimed at uplifting vulnerable communities. The budget outlines programs focused on:

Poverty alleviation to ensure basic needs are met.

Healthcare accessibility improvements for underprivileged groups.

Education reforms to enhance learning opportunities for all.

These initiatives reflect a holistic approach to fostering a more equitable society, in line with the Union Budget's overarching policies.

Economic Implications of Union Budget 2025

The Union Budget 2025 brings significant economic implications that experts are keen to analyze. It focuses on GDP growth and sectoral projections, outlining a detailed plan to boost the Indian economy. The expected rise in government spending could have a substantial impact on the economy's performance, setting the stage for future growth.

Impact on GDP Growth

Analysts predict the Union Budget 2025 could lead to a GDP growth rate of about 6-7%. The key driver is the investment in infrastructure development. This increased spending is expected to stimulate business activities across various sectors, driving economic expansion further.

Sectoral Growth Projections

The economic outlook for 2025 looks promising, with sectoral projections showing growth. Industries like technology, manufacturing, and services are set to benefit from targeted investments. These efforts aim to foster innovation and growth, potentially leading to more job opportunities, especially in rural areas.

Tax Reforms in Union Budget 2025

The Union Budget 2025 brings forth substantial tax reforms, aiming to transform direct and indirect taxes in India. It focuses on adjusting income tax slabs to boost disposable income for the middle class. This move is crucial for financial relief and to encourage more consumer spending.

To stimulate investments, the reforms target high-income earners with specific incentives. These incentives are designed to encourage investment in various sectors. The goal is to significantly impact economic growth and enhance capital flow.

The corporate tax structure also sees major adjustments. These changes aim to draw in foreign investments and boost domestic companies. By making the tax environment more favorable, businesses can reduce liabilities and increase funds for growth and innovation.

Indirect taxes, especially in the Goods and Services Tax (GST) framework, undergo significant changes. These modifications aim to simplify compliance for businesses. The goal is to improve tax collection efficiency, essential for sustainable economic growth.

The table below summarizes the key tax reforms and their potential budget implications:

Tax Type Proposed Changes Expected Outcomes

Income Tax Revisions to income tax Increased disposable slabs income for the middle class

Corporate Adjustments to corporate Attraction of foreign Tax tax rates investments

Indirect Improvements in GST Enhanced efficiency in Taxes compliance tax collection  These tax reforms mark a significant shift in fiscal policy,

with lasting budget implications. By refining income tax,

corporate tax, and indirect taxes, the government seeks to

boost revenue and foster equitable economic growth. This

approach is crucial for the development of various sectors.

Benefits for Small and Medium

Enterprises (SMEs) The Union Budget 2025 brings forward several measures

to boost Small and Medium Enterprises (SMEs). These

efforts not only improve financing access but also offer

crucial startup incentives. They contribute to a more

dynamic entrepreneurial environment. The government's

focus is on creating a supportive ecosystem for SMEs to

flourish. Incentives for Startups

The budget's startup incentives focus on promoting

innovation and technology-driven enterprises. Specific tax

benefits and direct grants are offered to startups. These

measures aim to alleviate initial financial burdens. This support not only stimulates growth but also fosters

job creation. New businesses often become major

employers in their communities.

These tax reforms mark a significant shift in fiscal policy,

with lasting budget implications. By refining income tax,

corporate tax, and indirect taxes, the government seeks to

boost revenue and foster equitable economic growth. This

approach is crucial for the development of various sectors.

Benefits for Small and Medium

Enterprises (SMEs) The Union Budget 2025 brings forward several measures

to boost Small and Medium Enterprises (SMEs). These

efforts not only improve financing access but also offer

crucial startup incentives. They contribute to a more

dynamic entrepreneurial environment. The government's

focus is on creating a supportive ecosystem for SMEs to

flourish. Incentives for Startups

The budget's startup incentives focus on promoting

innovation and technology-driven enterprises. Specific tax

benefits and direct grants are offered to startups. These

measures aim to alleviate initial financial burdens. This support not only stimulates growth but also fosters

job creation. New businesses often become major

employers in their communities.  Sector-Specific Allocations in Union

Budget 2025 The Union Budget 2025 highlights strategic sector-specific allocations. These are aimed at boosting growth

in key sectors like healthcare, education, and agriculture.

Such targeted investments aim to improve citizens' quality

of life and strengthen the economy . Healthcare Funding

A significant boost in healthcare funding is planned to

enhance public health infrastructure nationwide. The focus

will be on expanding healthcare services and improving

facilities. This will ensure all citizens have access to

quality medical care.

Sector-Specific Allocations in Union

Budget 2025 The Union Budget 2025 highlights strategic sector-specific allocations. These are aimed at boosting growth

in key sectors like healthcare, education, and agriculture.

Such targeted investments aim to improve citizens' quality

of life and strengthen the economy . Healthcare Funding

A significant boost in healthcare funding is planned to

enhance public health infrastructure nationwide. The focus

will be on expanding healthcare services and improving

facilities. This will ensure all citizens have access to

quality medical care.

Increased funding will also support initiatives to tackle major health issues. This move is expected to contribute to a healthier population. Education Sector Investments The budget emphasizes education investment, aiming to upgrade schools and universities. It will focus on increasing access to quality education through digital learning tools. These efforts aim to prepare students for the changing job market.

They ensure every child has the chance to succeed, regardless of their background. Agriculture Support Programs Agriculture support will receive substantial backing through various programs. These are designed to increase farmer incomes and enhance crop production. The focus will be on sustainable practices and technology use.

These initiatives aim to create a resilient agricultural

sector. It will be able to adapt to changing climates and

market demands.  Reactions from Economic Experts

and Politicians The Union Budget 2025 has sparked a wide range of

reactions from economic experts and politicians. These

reactions highlight the diverse perspectives on its impact.

Experts generally view the budget positively, seeing it as a

step towards stimulating growth and implementing

necessary reforms. They emphasize that it aligns with

India's long-term economic objectives.

Reactions from Economic Experts

and Politicians The Union Budget 2025 has sparked a wide range of

reactions from economic experts and politicians. These

reactions highlight the diverse perspectives on its impact.

Experts generally view the budget positively, seeing it as a

step towards stimulating growth and implementing

necessary reforms. They emphasize that it aligns with

India's long-term economic objectives.

On the political side, opinions are sharply divided along

party lines. Some politicians commend specific

allocations aimed at promoting development, seeing them

as crucial for social and economic progress. Conversely,

others voice their concerns, questioning the budget's

priorities and the adequacy of funding in certain areas.  The feedback from both economic and political circles

paints a mixed picture of expectations from the budget. A

common thread in these discussions is the balance

between fiscal prudence and ambitious growth plans.

Below is a summary of key reactions from notable figures

in both fields:

Source Reaction

Type Comments Economic Support Highlights growth- Expert-1 oriented

measures and necessary

reforms.

The feedback from both economic and political circles

paints a mixed picture of expectations from the budget. A

common thread in these discussions is the balance

between fiscal prudence and ambitious growth plans.

Below is a summary of key reactions from notable figures

in both fields:

Source Reaction

Type Comments Economic Support Highlights growth- Expert-1 oriented

measures and necessary

reforms.

Economic Critique Calls for more Expert-2 emphasis on sustainability and long- term planning. Politician A Support Applauds investment in infrastructure projects. Politician B Opposition Questions the funding levels for social welfare initiatives.

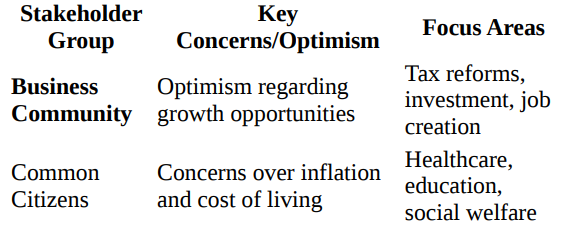

This range of responses illuminates the complex nature of budget discussions in India. The collective insights highlight the critical need for ongoing dialogue among economic experts and politicians as the budget is implemented. Public Response and Stakeholder Opinions The Union Budget 2025 has sparked a wide-ranging discussion among different groups. Each group shares its own views, shaped by their interests and experiences. This section delves into the perspectives of the business community and the reactions of everyday citizens. It highlights the diverse opinions that reflect the current economic mood. Business Community Views

Business leaders are generally upbeat about the Union Budget 2025. They see the new tax reforms and incentives as a boost for growth and innovation. Executives from big companies highlight the importance of lower tax rates for investments, which they believe will drive economic growth. Sectors like technology and manufacturing are expected to see significant benefits, sparking talks about job creation and increased productivity.

Their optimism is rooted in the belief that these measures will be effective. This positive outlook is crucial for the business sector's future. Common Citizens' Reactions On the other hand, citizens' reactions are more varied, often focusing on inflation and living costs. While some welcome the government's social welfare efforts, others doubt if the budget will meet pressing needs like healthcare and education. The public is skeptical, wondering if these policies will improve their daily lives.

People are sharing their hopes and fears online, offering a

more nuanced view of the public's response. This

engagement helps to understand the budget's potential

impact better.

Future Prospects Following Union

Budget 2025 The Union Budget 2025 introduces a mix of opportunities

and uncertainties, shaping India's economic future.

Stakeholders are keenly observing the implications, noting

both the expected benefits and potential hurdles. A

thorough grasp of these elements is critical for a solid

economic forecast.

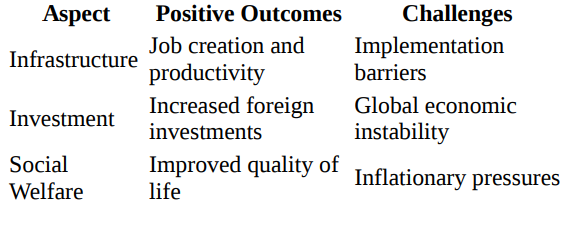

Anticipated Long-Term Effects

Experts foresee positive long-term outcomes from the

budget's key initiatives. Infrastructure investments are

expected to boost productivity, leading to:

Future Prospects Following Union

Budget 2025 The Union Budget 2025 introduces a mix of opportunities

and uncertainties, shaping India's economic future.

Stakeholders are keenly observing the implications, noting

both the expected benefits and potential hurdles. A

thorough grasp of these elements is critical for a solid

economic forecast.

Anticipated Long-Term Effects

Experts foresee positive long-term outcomes from the

budget's key initiatives. Infrastructure investments are

expected to boost productivity, leading to:

- Increased job creation across various sectors.

- Heightened foreign investment driven by improved business conditions.

- Enhanced social welfare programs leading to a better quality of life for citizens.

These developments are likely to increase consumer confidence, driving economic growth and strengthening India's global standing. Potential Challenges Ahead Despite the optimistic outlook, several challenges are on the horizon. Overcoming these will be crucial for the budget's success. Key challenges include:

1. Global economic instability, which may affect exports and international trade.

2. Policy implementation barriers, potentially hindering planned initiatives.

3. Inflationary pressures that could impact purchasing power and cost of living.

Addressing these obstacles is essential for the government

to achieve the budget's economic goals and ensure

continued growth.

Conclusion The Union Budget 2025 marks a significant step towards

boosting India's economic growth and resilience. It strikes

a balance between fiscal prudence and growth strategies.

This budget aims to meet the critical needs of various

sectors and support recovery post-pandemic. The outlined

provisions showcase a forward-looking strategy, focusing

on both immediate relief and long-term sustainability.

Conclusion The Union Budget 2025 marks a significant step towards

boosting India's economic growth and resilience. It strikes

a balance between fiscal prudence and growth strategies.

This budget aims to meet the critical needs of various

sectors and support recovery post-pandemic. The outlined

provisions showcase a forward-looking strategy, focusing

on both immediate relief and long-term sustainability.

Stakeholders from diverse sectors will closely examine the Union Budget 2025's implications. Ongoing evaluations are essential to gauge its effectiveness. These assessments will reveal how the budget's allocations, reforms, and incentives translate into real outcomes for businesses, communities, and the broader economy.

This conclusion emphasizes the need for ongoing dialogue and evaluation of the budget's impact. It highlights the budget's potential to mold India's economic landscape in the future. By monitoring developments and the changing landscape, decision-makers can capitalize on the budget's opportunities while tackling potential challenges. FAQ What are the key highlights of the Union Budget 2025? The Union Budget 2025 introduces crucial fiscal measures to boost economic growth. It focuses on infrastructure investments, social welfare initiatives, and increased government spending. This includes sectors like education and healthcare.

How does the Union Budget 2025 impact GDP growth?

Experts predict a GDP growth rate of 6-7% due to the budget. This is thanks to more investments in infrastructure and a business-friendly environment.

What tax reforms are introduced in the Union Budget 2025?

The budget revises income tax slabs and corporate tax structures. It also adjusts indirect taxes like the Goods and Services Tax (GST). These changes aim to simplify compliance and boost growth.

How will the Union Budget 2025 benefit Small and Medium Enterprises (SMEs)?

The budget aims to enhance SMEs' access to financing with low-interest loans and credit guarantees. It also offers tax benefits and incentives for startups. This is to encourage innovation and growth.

What are the sector-specific allocations in the Union Budget 2025?

The budget targets healthcare infrastructure, educational facilities, and agriculture. It aims to improve farmers' livelihoods and promote sustainable practices.

What is the public response to the Union Budget 2025?

Public opinion is divided. Businesses are optimistic about growth and tax reforms. However, average citizens worry about inflation and the budget's adequacy for their needs.

What are the anticipated long-term effects of the Union Budget 2025?

Successful implementation could lead to major infrastructure and social development advancements. This would positively affect India's economic stability and growth.

What potential challenges might arise post-Budget 2025?

Post-Budget challenges could include global economic instability, inflation, and policy implementation barriers. These could hinder the envisioned growth.